A Step-By-Step Explanation Of Global Supply Chain Problems & Its Effect On The Board Game Market

America’s supply chain infrastructure has been faced with unprecedented disruptions and record delays over the past year. In this article, we will map out the steps of the supply chain, its current roadblocks, and its impacts on the tabletop gaming industry as well as the American economy as a whole.

We start this deep dive off with some lighthearted Spiderman humor that accurately captures the blame game that each step of the supply chain is playing. We believe it’s an important topic to explore as it is one of the largest challenges that all businesses, and especially indie board game developers, are facing today. This report’s aim is to try to unravel an immeasurably complex system into a somewhat digestible understanding. Our hope is that we can give customers and creators a little more clarity on the current supply chain crisis as a whole. This can help each party manage expectations, reduce friction, and lean into a solution-first mindset to tackle a problem that is affecting nearly every industry.

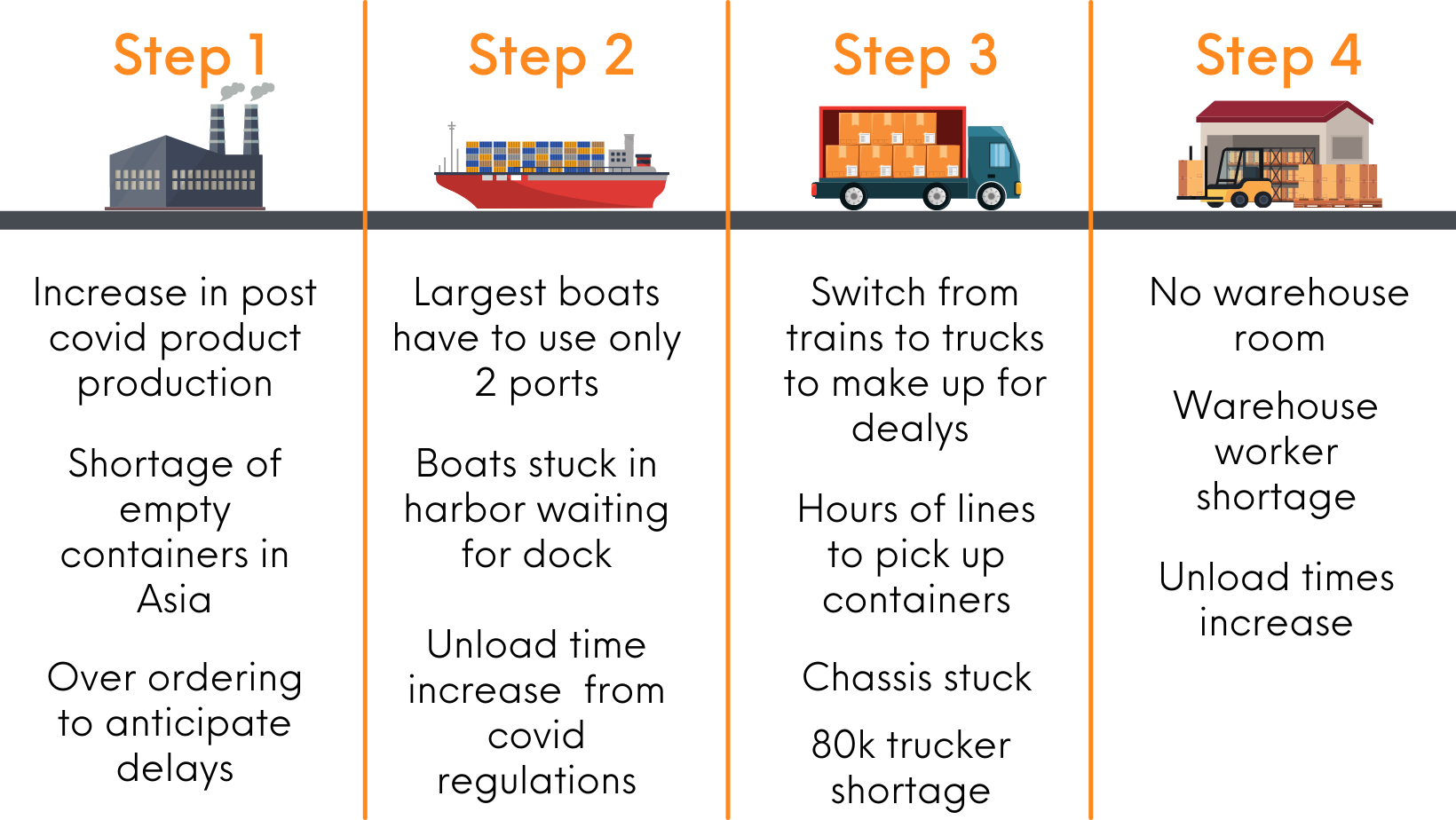

To better organize all the breakdowns in the system, we will be separating the journey of a board game (or any product) into four main sections: Asian Factories, US Ports, Interstate Transport, and Warehouses/ Businesses. These 4 steps create a giant loop and each has loops within loops. We will then examine how each of these steps impacts the board game market specifically as well as future complications to consider. To all our non-American readers, don’t click out! While we might not be directly examining every international supply chain challenge, we promise this will be similar to your situation, as, unfortunately, many of your woes are being caused by the United States (I know shocking).

The Most High-Level Summary Possible

Step 1- Asian Factories

Unsurprisingly, we can trace many of the current challenges back to the one and only Coronavirus. When people were unable to leave the house during the pandemic, spending habits switched from services to physical products. After factories reopened from the shutdowns, they had to process both the backlog of orders as well as new orders. The Wall Street Journal reported a 14% increase in imports in 2021 over 2020 and Morgan Stanley documented that, “spending on durables in October 2021 was 40% higher than it was in October 2019.”

Seeing the uptick in demand and realizing the inevitable delays, companies exacerbated the problem by preemptively placing larger-sized orders earlier in the year. This put a new, enormous stress on an already unbalanced system. Insider News documented that the first 9 months of 2021 alone saw an increase in cargo volume by 30%. Meanwhile, Flexport via CNBC, revealed that transit from Asia to North America has doubled since 2020.

Rolling into 2021 and 2022, the number of goods produced has continued to exceed the number of available empty containers in Asia. While there are several contributing factors, this particular issue also began at the start of 2020 during the months-long, covid shutdown of Asain factories. Anticipating financial losses from a potential covid-caused recession, many ocean carriers decided to cancel the shipment of empty containers in America back to Asia, according to McKinsey’s latest logistics report. As factories reopened, ready-to-ship products began to pile up without a method to get them to the consumer.

We should also examine an additional complicating factor: import vs export rates. Americans import at far greater rates than they export. This results in even more empty containers being stuck stateside. The other major roadblock is the lack of space on the ships themselves. The increased import demand and California port delays (more on this later) add another layer to an already expensive problem.

So what does all this mean for businesses? Simply put, massive spikes in shipping container costs. According to a 60 Minutes segment from December of 2021, standard containers that cost $2,000 pre-pandemic now have a price tag of up to $20,000! A quick terminology lesson, shipping containers typically fall into one of two categories: TEUs aka Twenty-foot Equivalent Unit (industry standard) and FEUs or a Forty-foot Equivalent Unit. While $20,000 a container may be at the extreme end, we can track the overall global rise of freight rates on Freightos Data’s Global Container Index.

Step 2- USA Ports

If you thought the challenges on the production side of this were bad, just wait for the biggest bottleneck, American Ports. The docking issues are a deadly recipe of one part increase in imports, one part labor shortages, and one part old cargo/ empty units not moving out of the way.

According to Flexport via CNBC, shipping transit from Asia to North America has doubled since 2020 leading to two times the amount of vessels being utilized. In 2018 The Office Of The United States Trade Representative last published that 67% of US imports come from the APEC region (Asian Pacific). CNBC points to another complicating factor, the largest vessels, therefore the most efficient and affordable, are unable to fit through the Panama canal. This contributes to 40% of imports coming through two California ports: Los Angeles and Long Beach. It is here we encounter our next large bottleneck.

In November of 2021, the Port of Los Angles, Via CNBC, noted that approximately 11.5% of the global vessels were “offline” due to being stuck in a queue just to get into a dock. In that same month, the Port Of Los Angles via Insider revealed that ships were waiting an average of 18.5 days to come into the docks. In February 2022, CNBC confirmed that there are still over 90 boats unable to enter the Port of Los Angeles.

Once a vessel pulls up it has to be unloaded. The December 60 Minutes special revealed that the average unload time went from 2 days to up to 9 days to unload just one boat. Covid regulations played a major role in the increased unload times. Even as recently as January of 2022, Port of Los Angeles stated that around 10% of dock employees contracted covid and were unable to work. This slow down compounds the shortages caused by the “The Great Resignation”. The Pew Research Center stated that the national “quit rate” reached a 20-year high last November. Meanwhile, Fortune Magazine quoted the Bureau of Labor Statistics and noted that the trade, transportation, and utility sector saw the second highest quit rate.

The final complicating factor for American Ports is the fact that all these additional cargo ships face a shortage of space to store the new product once it arrives. The Port of Los Angeles via CNBC reported that in October of 2021 40% of all imports were left at the ports for more than 9 days. A further 69,000 empty TEUs were taking up valuable space in February of 2022. Before the pandemic, most cargo sat at the ports for an average maximum of 2-4 days (depending on the delivery method). This stagnation led the ports of Long Beach and Los Angeles to charge companies fees of $100 a day for any container not picked up within 9 days of its arrival. Despite all of these issues, it is important to point out recent progress. For example, as of January of 2022, the Port of Los Angeles and Long Beach recorded a combined reduction of 62% of “aging cargo” at their respective locations.

Step 3- Interstate Transport

Trucks or trains? There is no right answer, as you are sure to have delays and markups with both methods. In a non-crisis environment transporting goods by train is both cheaper and better for the environment. TEUs can be loaded onto the freight trains and transport large quantities of items to several central hubs, in the middle of America. From a centrally located rail yard, a company’s products can then be divided into smaller shipments to specific warehouses/ fulfillment centers over much shorter distances. For a true deep dive into this process, check out this story in the Wall Street Journal! Long story short, in the summer of 2021, railyards reached their storage capacities and were unable to accept any more containers. On top of that, old product arrivals got stuck under new units, leaving businesses with no means of accessing their goods. 60 Minutes talked with one business owner who had been receiving fees for not picking up the cargo that he was unable to access. Unfair situations like this have started to drive people away from the railway option. In an attempt to try to make up time from the delays from the cargo ships, companies have looked to the faster, costlier, and less efficient alternative of trucking.

While switching intercontinental transport to trucks may sound like an expensive but better option, the reality is a bit grimmer. A Forbes article from January 2022 documented that 71% of the US economy is moved by truckers. The Wall Street Journal connects a 130% increase of trucks on the most popular route of LA to Chicago, with a 59% increase in the price of moving goods along this same route.

This same Forbes piece also reveals that the pre-pandemic turnover rate for truckers was already extraordinarily high at 94%. In December of 2021, the American Trucking Association via Insider News published data that stated that there was a shortage of 80,000 truck drivers. This trucker shortage is yet another result of the “Great Resignation”. Going back to the Pew Research Center, the top 3 reasons people disclosed as their reason for quitting were: low pay, not enough career-advancing opportunities, and feeling disrespected. Truck drivers certainly fall into the first category based on how the compensation system is currently structured. Rather than being paid by the hour, drivers are paid by the load. Additionally, Insider News detailed how, with too many TEUs sitting at the port, drivers can wait up to 8 hours in lines over 5 miles long to pick up their next delivery without any additional compensation.

Yet another complication lies in the constantly changing regulations around what units can and can not be returned. Once again highlighted in the 60 Minutes segment, daily changes to these guidelines mean that truckers with an empty container of a certain color are unable to return it to the port. This can become a massive problem given that a driver is unable to pick up a full container without first returning an empty one.

We can look back to that same 60 Minutes piece and learn that the pickup system itself has deep flaws. From the port’s perspective, they were seeing truckers miss their cargo pickups at a rate of around 30-50%. However, there is a major sticking point: the shortage of just one piece of equipment called a chassis. Freight Right defines this as, “a special trailer or attachment that allows ocean containers to be transported via truck. A chassis is required for shipments transitioning from sea to road…Chassis work by fitting snugly around the container, keeping it from moving around during transport…”. So where are all the missing chassis you might ask? Well, they are stuck in the shipyards under empty containers waiting to be shipped back overseas. And with no room for either empty or full containers, along with the necessary equipment to move these items being stuck, we find ourselves at yet another Catch 22.

Step 4- Warehouses & Businesses

The final phase of the supply chain, as far as this article is concerned, are warehouses. The Wall Street Journal wrote that unload times at warehouses have increased by 30%. There are two main reasons for this: not enough labor and not enough space.

While delays may be holding up stock abroad, when the items finally arrive many companies have ordered far beyond their facilities’ capacities. In December of 2021, Insider News via CBRE recorded warehouses near LA and Long beach only had 1% of their warehouse spaces open. Nationwide, warehouses were observing a 3.6% average, vacancy rate. This is the lowest capacity since 2002.

We revisit the “Great Resignation” to address the worker shortage here. Warehouse jobs are often seasonal, at odd hours, in loud environments, and difficult on the body. Low pay, poor benefits, and training times make for another logistical nightmare at the final step of the supply chain. Forbes investigated this problem back in October of 2021 and recorded that the Department of Labor has listed 490,000 industry openings in July of 2021 in both the warehouse and trucking industries (the Department of Labor doesn’t separate these industries). As you saw earlier, the trucking industry confirmed a need for 80,000 truckers so do the math and you will see warehouses are also in dire need of employees.

Board Game Industry Deep Dive

The board game industry is facing delays and additional expenses from all the aforementioned supply chain disruptions. However, the industry on a whole, and especially indie game developers, are experiencing issues at an even higher rate. To get a better handle on this, I cannot recommend enough the Podcast Ludology episode titled “GameTek 255.5 - Global Logistics Woes”. In it, the two hosts, Geoff Engelstein & Gil Hova, talk to a logistics specialist, Justin Bergeron of ARC Global Logistics, who works with a lot of board game companies and knows the ins and outs of this market. This episode came out in August of 2021 but it makes Justin’s predictions of what has continued to happen that much more impressive. So, with this in mind, let's turn to a couple of the hurdles that intensify the effects of supply mismanagement for the tabletop gaming industry specifically.

Board game companies saw some of the largest growth rates out of any industry resulting from covid. We can look back at last year’s covid market impact article and see that Technavio reported a 25% growth rate for the industry and Kickstarter saw a 33% funding increase in the tabletop gaming segment. So right off the bat, board game developers saw an additional demand higher than many other industries.

Time Magazine has a great article with several interviews that details how board games utilize many raw materials that are sourced in Asia. This, along with cheaper labor, has led to numerous factories in places like China becoming the ideal spot to produce games. The Ludology podcast also gets into how Chinese manufacturers allow for much more customization in game components compared to their Western counterparts. So, economically and skill-wise Asia has become the only option to manufacture games.

The board game market is pretty fragmented. While there are big players like Hasbro, Kosmos, etc, a significant portion of the market is divided between many small, indie developers. While this makes for a fantastic diversification of products and wonderful opportunities for small business owners, it also leaves the small game developers disproportionately vulnerable to the large shipping corporation's rate hikes. The larger game developers have the ability to spread their expenses across big shipments with other merchandise. They can even leverage retailers like Walmart and Amazon to help reduce costs and delays.

On the Ludology podcast, they discuss how one of the more unique challenges facing the tabletop gaming industry is order size. The nature of Kickstarters as well as small businesses not wanting to incur the expense of holding large quantities of unsold stock, oftentimes leads indie developers to order smaller quantities at less predictable intervals. Small order sizes do not take up an entire TEU, leaving small game companies reliant on another business to split the transport fees with them.

The Ludology podcast also details how board games, and all their many pieces, have a much higher density to volume ratio. This makes using freighters significantly more cost-effective as they charge by the space the goods take up in a TEU. On the other hand, this makes alternate transportation methods such as air freight prohibitively more expensive since they charge by a product’s actual weight.

Smaller companies, especially those utilizing crowdfunding, have closer “relationships” with their customers than the average company. So when raised prices become necessary, board game customers feel it more personally, as if they were “a part” of the launch experience and were “promised a price”. The backlash can be punitively unfair to small businesses. This is one of the main reasons we wrote this article, in an attempt to raise awareness among the general population of just how complex this shipping crisis is and how disproportionately affected small indie games feel its negative impacts.

Looking Forward

The moral of this supply chain horror story is that dependence on foreign manufacturing has finally caught up with Americans. The pendulum must swing back to local factory production, most likely through leveraging new automation technology. Both European and Asian countries are already using significantly advanced automation processes at their ports while the United States sits decades behind. Even with government intervention, Business Insider revealed that experts are predicting that shipping costs will continue to rise well into 2023.

Foreign policy will also play an increasing role in the near future. There is uncertainty about how China’s “zero covid policy” will play out going forward. This month China halted manufacturing but then walked it back a week later according to Bloomberg.com . This flip-flopping is dovetailing with the already tense relationships between these two countries from the “Trade War”. Also, with the potential of China backing Russia and therefore falling under the current Russian trade sanctions, the Eastern European crisis has the potential to devastate the supply chain even more than it currently has. The Harvard Bussiness Review informs us that of of the first repercussions will be skyrocketing petroleum prices rippling through the already exorbitant transportation rates. Additionally, some industries were dependent on Russia and Ukraine for raw materials and vital components. Looking forward, places like Texas are becoming the front-runner as the epicenter of the next generation of American manufacturing.

To find near-term solutions, it’s time to take a page from some of the world’s largest corporations. CNBC details how Amazon has fared relatively unscathed during all these disruptions thanks to owning and operating the majority of its supply chain. They ramped up making their own TEUs, hired their own truck drivers, acquired smaller cargo vessels that can unload at smaller and therefore less congested ports, and even invested in their own air freight fleet. In another example, their competitors like Walmart and Home Depot decided to put aside their competing market overlap and worked with each other to help reduce stalls and price raises by sharing the space and cost of both the containers and trucks. Perhaps it is time for indie board game developers to open up more lines of communication with each other and coordinate their production and shipping to most efficiently get their goods stateside.

Final Thoughts

While the world and America tries to figure out their multi-industry supply chain problems, Tabletop Simulator is always here as a great digital alternative, especially for small indie companies. To help spread this resource and get the word out about up-and-coming new games, the TTS Blog invites smaller game companies and board game enthusiasts alike to check out our Tabletop Talks and Playtesting Promotion Series. This is a great way to find exciting new games that you can try out on Tabletop Simulator while also supporting these companies’ various campaigns. If you are interested in having your game featured you can fill this form out here! We hope this article was helpful in breaking down a very complicated system and that the average board game consumer can come away from reading this with a little more sympathy for the delays from the indie board game developers we love and cherish.

Please utilize our sources to learn more from experts as we can promise you, there is so much more to learn about this interesting and important subject! Click here to get an organized list of all our fantastic sources and enjoy going down the logistics rabbit hole!

Let us know your thoughts!

What have your experiences been during the shipping crisis? Are you a developer trying to navigate delays and pricing? Are you a frustrated customer waiting for your already paid-for game? Do you have any creative solutions? Share your opinions in the comments below!